Why in the News?

The Enforcement Directorate (ED) is currently at the center of multiple high-profile investigations, including the Delhi excise policy scam involving prominent politicians like Arvind Kejriwal and Manish Sisodia. The Supreme Court is also reconsidering a 2022 judgment that strengthened the ED’s powers to search, seize, and arrest under the Prevention of Money Laundering Act (PMLA). Furthermore, the Central Government recently listed 16 entities that must mandatorily share information with the ED under Section 66 of the PMLA to facilitate coordinated investigations.

The growing international scrutiny by the Financial Action Task Force (FATF) and the Asia-Pacific Group on Money Laundering (APG) has placed additional pressure on India to bolster its anti-money laundering framework. Recent reports like the Panama Papers and Pandora Papers have exposed the international nature of money laundering networks, necessitating tighter regulation and enhanced international cooperation. The public’s demand for greater transparency and accountability in financial investigations has also brought the ED’s role into the spotlight.

Relevance to the UPSC Exam

Prelims:

- Polity and Governance:

- Structure, functioning, and role of government agencies like the ED.

- Statutory and regulatory bodies like the Financial Intelligence Unit (FIU).

- Economic Development:

- Economic growth and development, financial institutions.

- Government policies related to the Indian economy.

Mains:

- GS Paper II (Polity & Governance):

- Government policies and interventions (PMLA, ED).

- Statutory, regulatory, and quasi-judicial bodies (FIU, ED, CBI).

- GS Paper III (Economy & Security):

- Indian economy: Resource mobilization, growth, and development.

- Security challenges: Terror financing, organized crime, and cybersecurity.

Essay:

- Ethical Issues:

- Corruption, governance challenges, and regulatory misuse.

Introduction

Money laundering is a pervasive economic crime that significantly threatens India’s financial system and economic stability. It is concealing the origins of illegally obtained funds, making them appear legitimate. According to the International Monetary Fund (IMF), global money laundering is estimated to account for 2-5% of the world GDP. In India, where illegal financial activities are prevalent, curbing money laundering remains a crucial goal. This article provides a detailed analysis of money laundering in India, the role of the Enforcement Directorate (ED), and the evolving legislative landscape.

Understanding Money Laundering

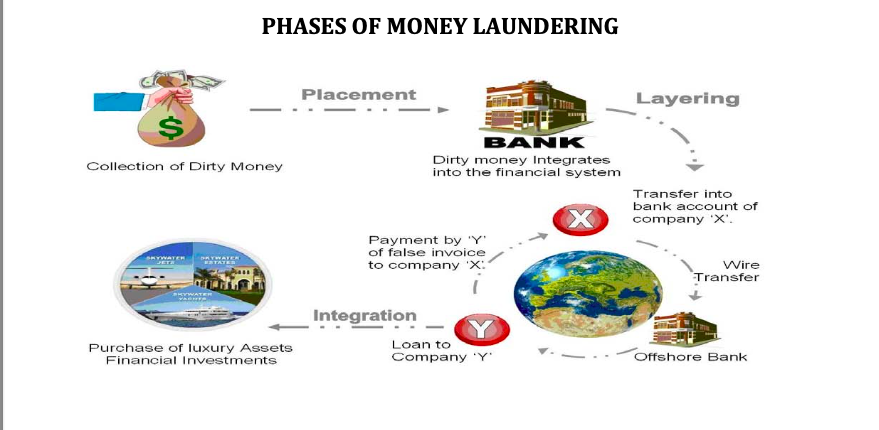

Money laundering involves three stages:

- Placement: Introducing illicit funds into the financial system, often in small amounts to avoid detection. Examples include:

- Depositing cash into bank accounts below the reporting threshold.

- Purchasing high-value assets like real estate, luxury cars, or jewelry.

- Converting cash into traveler’s cheques or foreign currency.

- Layering: Concealing the origin of the funds through a complex web of financial transactions. Examples include:

- Transferring funds through multiple bank accounts or financial institutions in different countries.

- Investing in shell companies to obscure ownership.

- Using trade-based laundering techniques like under-invoicing or over-invoicing.

- Integration: Reintroducing laundered funds into the legitimate economy. Examples include:

- Investing in legitimate businesses, often in real estate, hotels, or the stock market.

- Creating offshore trusts and companies to manage assets.

- Using laundered funds for political donations or philanthropic activities.

Source – Assocham

How does money laundering work? – Delena D. Spann

Watch this TEDx Video to understand the working of Money Laundering in Details

Impact of Money Laundering

- Economic Impacts:

- Legitimacy Undermined:

- Example: In the Sahara Group case, illegal funds were allegedly routed through multiple offshore entities to obscure their origin, undermining public trust in India’s corporate sector.

- Financial Market Instability:

- Example: The collapse of Satyam Computer Services in 2009 exposed large-scale fraud, leading to investor panic and stock market instability.

- Revenue Loss:

- Example: Estimates suggest that black money in India’s parallel economy results in annual revenue losses of over INR 1 lakh crore【17†source】.

- International Capital Flows:

- Example: The HSBC Swiss Leaks revealed that billions were siphoned to Swiss accounts, causing massive outflows from India.

- Social Impacts:

- Increased Criminality:

- Example: The drug trade in Punjab is fueled by money laundering networks that enable criminals to operate with impunity.

- Erosion of Public Trust:

- Example: Repeated bank frauds involving politicians and business tycoons have eroded public trust in financial institutions.

- Deterioration of Social Values:

- Example: Politicians and celebrities using laundered funds for election campaigns or philanthropic causes create a false image of prosperity.

- Political Impacts:

- Political Instability:

- Example: The involvement of high-profile politicians in scams like the 2G spectrum scandal and the Commonwealth Games scam created distrust in the political system.

- Criminalization of Politics:

- Example: In the Narada Sting case, West Bengal politicians were caught on camera accepting bribes from a fictitious company.

Evolution of Money Laundering Discourse in India

- Pre-1990s Era:

- Focus: Combating corruption, tax evasion, and smuggling.

- Key Turning Points:

- Criminal Law Amendment Ordinance (1944): Focused on corruption and breach of trust.

- Foreign Exchange Regulation Act (FERA) (1947): Restricted foreign exchange transactions.

- Narcotic Drugs and Psychotropic Substances Act (1985): Targeted drug trafficking.

- 1990s – 2000s Era:

- Focus: Organized crime and black money.

- Key Turning Points:

- Economic Liberalization (1991):

- Opened India’s economy, leading to rapid growth in cross-border transactions.

- The Hawala Scandal (1991-1995):

- Politicians and businesspersons were implicated in illegal foreign exchange transactions through the hawala network.

- PMLA (2002):

- Introduced a comprehensive legal framework for combating money laundering.

- Economic Liberalization (1991):

- Post-2008 Era:

- Focus: Anti-terror financing and global compliance.

- Key Turning Points:

- Mumbai Terror Attacks (2008):

- Prompted a stronger focus on terror financing.

- FATF Membership (2010):

- India became a full-fledged member, aligning its laws with global anti-money laundering norms.

- Commonwealth Games Scam (2010):

- Exposed corruption and money laundering involving public officials.

- Mumbai Terror Attacks (2008):

- Recent Developments:

- Fugitive Economic Offenders Act (2018):

- Addressed the issue of economic offenders absconding from India.

- COVID-19 Pandemic (2020-2022):

- Led to an increase in cybercrime and digital money laundering.

Evolution of Legislation Related to Money Laundering and Supreme Court Judgments

- The Prevention of Money Laundering Act (PMLA), 2002:

- Driver of Change:

- Global pressure due to India’s increasing integration with international financial markets.

- Key Provisions:

- Defines money laundering as a criminal offense.

- Provides for the confiscation of property derived from money laundering.

- Mandates reporting of suspicious transactions.

- Important Cases:

- Vijay Madanlal Choudhary vs Union of India (2022):

- Summary: The Supreme Court upheld the constitutionality of various PMLA provisions, including ED’s powers under Section 50.

- Impact: Affirmed the ED’s powers to investigate and prosecute money laundering offenses.

- Vijay Madanlal Choudhary vs Union of India (2022):

- Foreign Exchange Management Act (FEMA), 1999:

- Driver of Change:

- Economic liberalization and the need to regulate foreign exchange transactions.

- Key Provisions:

- Focuses on regulation rather than penalizing.

- Empowers ED to investigate and prosecute violations.

- Important Cases:

- Satyam Scam:

- Summary: ED used FEMA to investigate foreign exchange violations in Satyam Computer Services.

- Impact: Highlighted the interconnectedness of money laundering and corporate fraud.

- Satyam Scam:

- Fugitive Economic Offenders Act (FEOA), 2018:

- Driver of Change:

- High-profile cases of offenders absconding from India (Vijay Mallya, Nirav Modi).

- Key Provisions:

- Empowers ED to confiscate properties of absconding economic offenders.

- Applies to offenses involving INR 100 crore or more.

- Important Cases:

- Nirav Modi Case:

- Summary: Nirav Modi, accused of defrauding PNB of INR 11,000 crore, fled India and was declared a fugitive economic offender.

- Impact: Demonstrated the need for stringent laws to deal with absconding offenders.

- Nirav Modi Case:

Role of the Enforcement Directorate (ED)

- Overview and History:

- The Enforcement Directorate (ED) was established in 1956 to enforce foreign exchange laws.

- It operates under the Department of Revenue, Ministry of Finance.

- Initial Mandate: Enforce the Foreign Exchange Regulation Act (FERA).

- Mandate and Powers:

- Key Functions:

- Investigate offenses under PMLA and FEMA.

- Attach and confiscate properties linked to money laundering.

- Prosecute offenders in designated courts.

- Powers:

- Summon any person for evidence (Section 50, PMLA).

- Arrest offenders (Section 19, PMLA).

- Attach and seize properties (Section 5, PMLA).

- Coordination with Other Agencies:

- Collaborates with CBI, Income Tax Department, FIU, etc.

- Organizational Structure:

- Headed by a Director, with regional offices across India.

- Officers are drawn from IRS, IPS, IAS, and other agencies.

- Regional Offices: Mumbai, Chennai, Chandigarh, Kolkata, Delhi.

- Recent Notable Cases:

- Vijay Mallya Case:

- ED attached properties worth INR 9,000 crore linked to the absconding businessman.

- Nirav Modi Case:

- ED seized properties worth INR 1,400 crore and pursued extradition.

- Chidambaram Case:

- Former Finance Minister was arrested for alleged involvement in the INX Media scam.

- Arvind Kejriwal Case:

- ED interrogated Delhi Chief Minister Arvind Kejriwal in connection with the Delhi excise policy scam.

- The alleged scam involves manipulation of liquor licensing and distribution policies.

- Delhi Excise Policy Scam:

- ED arrested Delhi Deputy Chief Minister Manish Sisodia for his alleged involvement in irregularities related to the liquor licensing policy.

- ED attached assets worth INR 76 crore linked to the scam.

10 Important Pointers for the UPSC Prelims Exam

- Stages of Money Laundering:

- Placement: Introduction of illicit funds into the financial system.

- Layering: Concealing the origin of funds through complex transactions.

- Integration: Reintroducing laundered funds into the legitimate economy.

- Prevention of Money Laundering Act (PMLA), 2002:

- Defines money laundering as a criminal offense.

- Empowers the ED to investigate and confiscate properties linked to money laundering.

- Enforcement Directorate (ED):

- A multi-disciplinary agency enforcing PMLA and FEMA.

- Coordinates with other agencies like CBI, the Income Tax Department, and FIU.

- Notable Cases Investigated by ED:

- Vijay Mallya Case: ED attached properties worth INR 9,000 crore.

- Nirav Modi Case: ED seized properties worth INR 1,400 crore and pursued extradition.

- Delhi Excise Policy Scam: Arrest of Manish Sisodia for alleged irregularities in liquor licensing.

- Foreign Exchange Management Act (FEMA), 1999:

- Focuses on regulation rather than penalizing foreign exchange violations.

- Allows ED to investigate and prosecute offenders.

- Fugitive Economic Offenders Act (FEOA), 2018:

- Enables ED to confiscate properties of absconding economic offenders.

- Applies to offences involving INR 100 crore or more.

- Key Supreme Court Judgments:

- Vijay Madanlal Choudhary vs Union of India (2022):

- Upheld the constitutionality of various PMLA provisions.

- Nitin Jain Liquidator PSL Limited vs Enforcement Directorate:

- Highlighted conflicting powers between ED and insolvency professionals.

- Global Anti-Money Laundering Frameworks:

- FATF Recommendations: India follows the FATF 40 Recommendations.

- Egmont Group: Global network of FIUs for information exchange.

- Challenges and Criticisms of ED:

- Accusations of political bias and lack of transparency.

- Conflicts between PMLA, FEMA, and IBC create legal ambiguities.

- Recent Developments in Legislation:

- PMLA (Amendment) Act, 2012: Added the concept of ‘reporting entity.’

- COVID-19 Pandemic (2020-2022): Led to an increase in cybercrime and digital money laundering.

Key Challenges and Criticisms

- Overreach and Political Bias:

- Fact: ED’s actions are often perceived as targeting opposition politicians.

- Example:

- West Bengal CM Mamata Banerjee accused the ED of unfairly targeting her party leaders in the Narada Sting case.

- Case Study:

- Chidambaram Case:

- Allegation: The arrest was politically motivated due to his role in opposition politics.

- Outcome: The Supreme Court granted him bail, citing a lack of direct evidence.

- Counter-Argument:

- The ED and government argue that investigations are conducted without political bias, with political cases accounting for only 2-3% of the overall cases dealt with by the ED and all actions are evidence-based.

- The Delhi excise policy scam is cited as a case where multiple parties were scrutinized, including those aligned with the ruling government.

- Chidambaram Case:

- Lack of Transparency:

- Fact: ED often does not disclose investigation details, leading to concerns about fairness.

- Example:

- The media frenzy around the Nirav Modi case before concrete evidence was disclosed.

- Case Study:

- Vijay Mallya Case:

- Allegation: Media trials harmed Mallya’s reputation before he was formally charged.

- Outcome: Mallya’s legal team used media bias as a defense strategy.

- Counter-Argument:

- The ED counters that secrecy in investigations is necessary to avoid alerting suspects and prevent tampering with evidence.

- The government emphasizes that revealing sensitive information prematurely could compromise national security.

- Vijay Mallya Case:

- Overlap with Other Laws:

- Fact: Conflicts between PMLA, FEMA, and IBC create legal ambiguities.

- Example:

- The Nitin Jain Liquidator PSL Limited case highlighted conflicting powers between the ED and insolvency professionals.

- Case Study:

- Directorate of Enforcement vs Manoj Kumar Aggarwal:

- Issue: Whether ED can attach assets during the insolvency process.

- Outcome: The court emphasized the primacy of IBC over PMLA.

- Counter-Argument:

- The government argues that the ED’s powers are crucial to prevent offenders from using insolvency as a shield.

- Streamlining cooperation between agencies is proposed to resolve jurisdictional conflicts.

- Directorate of Enforcement vs Manoj Kumar Aggarwal:

- Challenges in Prosecution:

- Fact: Money laundering cases often involve complex transactions and international jurisdictions.

- Examples:

- The Nirav Modi case required coordination between multiple agencies and jurisdictions, delaying prosecution.

- Case Study:

- Sahara Group Case:

- Allegation: Sahara used offshore entities to obscure illicit funds.

- Outcome: ED struggled to trace the funds due to offshore jurisdictional barriers.

- Counter-Argument:

- The government argues that international cooperation frameworks like FATF and Interpol are improving, but challenges remain due to varied legal systems.

- Sahara Group Case:

- Handling Sensitive Cases:

- Fact: High-profile cases involve sensitive political, economic, and social factors.

- Examples:

- Investigating politicians like P. Chidambaram and Arvind Kejriwal created public backlash.

- Case Study:

- INX Media Case:

- Allegation: P. Chidambaram was involved in granting illegal FIPB approvals.

- Outcome: Public protests and accusations of political vendetta marred the investigation.

- Counter-Argument:

- The government emphasizes that no individual, regardless of position, is above the law.

- Judicial oversight and parliamentary scrutiny are cited as checks on the ED’s powers.

- INX Media Case:

International Nature of Money Laundering Cases

- Global Challenges:

- Cross-Border Complexity:

- Financial transactions span multiple jurisdictions, making tracking difficult.

- Offshore Financial Centers:

- Shell companies in tax havens obscure true ownership and facilitate layering.

- Cryptocurrency Risks:

- Digital currencies provide anonymity, enabling rapid cross-border transfers.

- International Agreements and Cooperation:

- FATF Recommendations:

- The Financial Action Task Force (FATF) sets global anti-money laundering standards.

- India is a full member and follows the FATF 40 Recommendations.

- Egmont Group:

- A global network of FIUs to facilitate information exchange.

- Bilateral Treaties:

- India has extradition and mutual legal assistance treaties with multiple countries.

Case Studies:

- USA:

- Panama Papers Leak:

- Revealed how US citizens used offshore companies for money laundering.

- Led to increased scrutiny of offshore entities.

- Bernie Madoff Ponzi Scheme:

- Involved layering through multiple investment funds and international banks.

- Highlighted the need for stringent monitoring of financial transactions.

- UK:

- Unexplained Wealth Orders (UWO):

- Introduced in 2018 to target illicit funds hidden in UK real estate.

- Case: Zamira Hajiyeva, wife of an Azerbaijani banker, was the first target under UWO.

- EU:

- Danske Bank Scandal:

- Involved laundering of $230 billion through Estonian branches.

- Led to tighter EU anti-money laundering regulations.

- Australia:

- CBA Scandal:

- The Commonwealth Bank of Australia was fined for failing to report suspicious transactions.

- Prompted a nationwide review of banking compliance.

- CBA Scandal:

- Danske Bank Scandal:

- Unexplained Wealth Orders (UWO):

- Panama Papers Leak:

Way Ahead

- Government Recommendations:

- Financial Intelligence Unit (FIU):

- Strengthen information-sharing mechanisms among agencies.

- Utilize artificial intelligence for anomaly detection in financial transactions.

- Reserve Bank of India (RBI):

- Enhance due diligence for high-risk customers.

- Monitor non-banking financial institutions more closely.

- Judicial Oversight and Committees:

- Supreme Court Directives:

- Ensure accused individuals are provided with the Enforcement Case Information Report (ECIR).

- Expedite trials to avoid prolonged pre-trial detention.

- Parliamentary Committees:

- Streamline cooperation between agencies like ED, CBI, and the Income Tax Department.

- Improve transparency in ED investigations to address political bias concerns.

- International Cooperation:

- FATF Recommendations:

- Implement effective measures for beneficial ownership transparency.

- Enhance international cooperation through information-sharing networks.

- Interpol:

- Utilize Red Notices for extraditing economic offenders.

- Collaborate with Europol and other regional bodies for coordinated enforcement.

Conclusion

Money laundering remains a persistent threat to India’s economic and political stability. Despite significant legislative progress and a proactive Enforcement Directorate, challenges like political bias and lack of transparency undermine enforcement efforts. India’s anti-money laundering framework must be continuously strengthened to adapt to evolving threats. As global financial networks become more interconnected, the country must leverage international cooperation and data analytics to effectively combat money laundering.

Probable Prelims and Mains Q’s from the above Topic –

Prelims Q’s –

- Which of the following stages are involved in Money Laundering?

- A) Placement

- B) Layering

- C) Integration

- D) All of the above

- The Enforcement Directorate is primarily associated with which of the following acts?

- A) The Prevention of Corruption Act

- B) The Prevention of Money Laundering Act

- C) The Foreign Exchange Management Act

- D) Both B and C

- Under which ministry does the Enforcement Directorate operate?

- A) Ministry of Home Affairs

- B) Ministry of Finance

- C) Ministry of External Affairs

- D) Ministry of Corporate Affairs

- Which Act was enacted to empower the Enforcement Directorate to confiscate properties of economic offenders fleeing the country?

- A) Fugitive Economic Offenders Act, 2018

- B) Prevention of Money Laundering Act, 2002

- C) Benami Transactions (Prohibition) Amendment Act, 2016

- D) None of the above

Mains Questions:

- Discuss the role of the Enforcement Directorate in curbing money laundering in India. Illustrate with recent cases where the ED has played a pivotal role.

- Analyze the impact of the Prevention of Money Laundering Act (PMLA), 2002 on the financial governance of India. How effective has it been in deterring financial crimes?

- Critically evaluate the challenges faced by the Enforcement Directorate in the enforcement of the Prevention of Money Laundering Act. Suggest measures to enhance its effectiveness.

- Examine the role of international cooperation in combating money laundering. How can India enhance its global engagements through agencies like the Enforcement Directorate to combat cross-border financial crimes?

UPSC GS Foundation Prelims+Mains for 2026

UPSC GS Foundation Prelims+Mains for 2026